The Bossy State of the 21st century

Today, we see a new paradigm shift in the relationship between state and business. The bossy state is the new status quo. A state driven by the population’s demand to find solutions to social justice and climate by actively intervening in the economy.

Throughout history, the relationship between business and government has been volatile. After WW2, governments in many countries believed it would be better to rebuild society with the state taking ownership of companies. This was not a product of ideology. Both ideologically left and right governments in Western Europe saw state intervention as necessary to rebuild the war-shattered economies. The interventionist presence of the state in business came to an end in the 80s as neoliberal ideas gained popularity in major western economies. In the 80s, the state retreated from state-owned enterprises to fill the void as referee and strictly monitor if companies followed the rules in the global markets. Today, we see a new paradigm shift in the relationship between state and business. The bossy state is the new status quo. A state driven by the population’s demand to find solutions to social justice and climate by actively intervening in the economy.

The shift in both the US and the EU’s antitrust approach highlights a change from protecting the consumers alone to the protection of other actors such as smaller firms. Earlier, firms had to satisfy their shareholders alone, nowadays most firms juggle between satisfying several stakeholders such as protecting communities of local people or protecting biodiversity. The social demands aimed at firms increase as technology makes accountability through surveillance possible. Behind it all, many states and supranational institutions have positioned themselves as having the solution to the issue. The solution is a firmer grip on business and a stronger and more far-reaching government. It is seen in the European Union’s emphasis on strategic autonomy and industrial policy, moving away from free markets. The antitrust machine, that is the European Commission, is opening more cases and cementing that we have entered the age of the bossy state. New investigations from the EU include a sectoral inquiry into the Internet-of-Things sector and separate investigations of both Amazon and Apple.

The once so celebrated technology companies have grown themselves larger than the national institutions by disrupting the way of living. We do not send letters; we send texts on Facebook. We do not store pictures in a box; we post them on Instagram. Our existence is placed on these platforms. Opinions are formed and spread there. Lawmakers are starting to realize this as people use the platforms to gain power in conventional spheres such as politics. This was seen with the Brexit referendum, where Cambridge Analytica used big data and Facebook to gain voters for the leave-side; we might never know whether this was the deciding factor of the leave-side winning, but it definitely played a major role. The ten biggest tech companies are now twice as large as they were five years ago. But are the tech companies as evil as they are portrayed in the media?

The mechanisms behind big tech

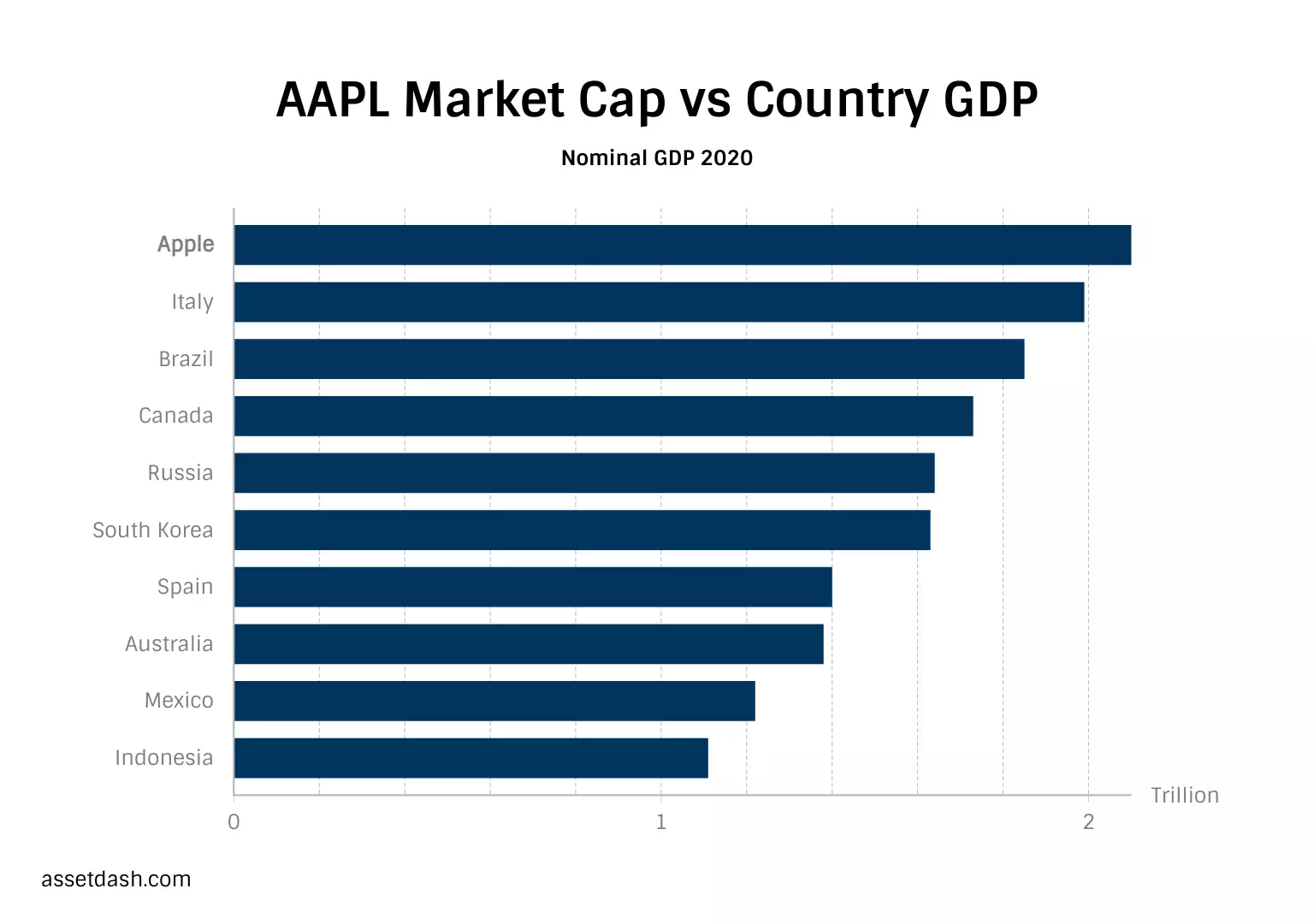

In 2020, Apple’s market cap rose above the GDP of countries such as Italy, Canada, Russia, and Brazil. This prompts the question: what mechanisms and strategies propel a company to become higher valued than many developed nations? You might have heard about the term network effects, which are the main growth engine behind the tech companies.

The tech companies’ growth is directly related to network effects, where every new participant on the network improves the value and efficiency of the network, reducing marginal costs and increasing competition as the network grows. As a result of increased competition, both greater variety of products and lower prices immerse. As the tech platforms lower the barrier to entry, they stimulate innovation, entrepreneurship, and employment. Furthermore, tech platforms reduce the importance of geography, increasing cross-border transactions within the markets and increasing the potential market size for companies - again intensifying competition. And as you can tell, in the early years of the platforms, they provide immense value in the markets they disrupt with very little side effect. This is in effect built into the business model, as the platforms must incentivize people to use their platform before it becomes mainstream, where recruitment of users becomes self-reinforcing through feedback loops.

What challenges do tech companies pose to free and fair competition?

Conflicts of interest arise when platform owners also become producers on their own platform, taking on a dual role. This is seen with Amazon, which both owns Amazon Marketplace, but also sells its products on the platform. Two separate issues come to light here. Firstly, Amazon owns all the data on the platform, which is not necessarily shared with sellers, creating information asymmetry in favor of Amazon. Secondly, predatory pricing can become prevalent, as in the case of Amazon, which is the practice of lowering prices to put competitors out of business. Predatory pricing is especially damaging towards small businesses, which does not stand a chance against the big platforms. The tech platform's strong information asymmetry combined with predatory pricing practices raises serious challenges for a fair, level playing field in the market.

The growth of the platform economy is based upon extreme scale and network effects. This has positive effects such as lowering prices, giving customers more choices, etc. But the downside is that it tends to concentrate users on a few platforms, creating oligopolies and in some cases monopolies. High switching costs, connected to transitioning from one platform to another, also plays a crucial role in the concentration of market share. The combination of strong network effects and high switching costs together create lock-in effects, which is the inability to move to another platform. Strong lock-in effects create a competitive advantage, which results in winner-take-all, hence oligopolistic or monopolistic tendencies. Moreover, studies indicate that increased digitalization has resulted in rising market concentration and increased mark-ups for the top percentile of companies.

Economics 101 teaches that industries with monopolies lead to worse quality and higher prices for consumers. But with the rise of technology companies, some argue that monopolies might not be that bad. One of the proponents of monopolies is Peter Thiel, who argues that monopolies are a result of innovation and not an inconsistency of the markets. Monopolies only stand if there is no new innovation. Google has a near-monopoly on search in Europe, but it could be argued that is only the case as no better innovative solution has been found to search. Thiel argues that hyper-competitive sectors such as the restaurant business are bad businesses and the reason for them being hyper-competitive is that they have not been disrupted, or no major change has happened in the industry. This argument is a direct attack on the fascination of free competition by which authorities in the last decades have been consumed. This is not to argue that monopolies are good, but to present both sides of the nuanced debate on tech companies’ effect on markets.

The speed at which the platform economy evolves is immense. The gap between losers and winners is widening much quicker compared to traditional businesses. We might enter the age of the bossy state, but legislation and government still moves at snail speed through the barriers of red tape. The slow legislative process might be one common denominator when looking at other times of technological disruption in history. This poses challenges regarding the enforcement of antitrust rules, as most rules in this area only allow intervening ex-post (after the abusive incident has occurred). Therefore, intervention often tends to be too late in the quickly, ever-changing digital markets. This is reflected in the EU’s antitrust case against Google, where complaints were made in 2009 to the European Commission, but the fine was imposed in 2017, 8 years later. Some might argue that the fine imposed on Google was relatively small, given that Google could operate with anticompetitive behavior and distort competition for at least 8 years before being fined, and during this time grow their platform substantially. If the bossy state intends to shape the technological landscape, it needs to create a playing ground that prevents distortion of free competition instead of endlessly chasing old offenses.

Conclusion

The bossy state interventionism is a high-stakes game without a clear winner. Is the discussion about taming the digital monopolies of the 21st century, or is it a rebranding of the modern state? The support of the EU has been questionable in recent years with Brexit and the rush of populism in southern European countries. The European Commission’s renewed focus on antitrust cases (A Europe Fit For The Digital Age) and green policies indicates that many current institutions such as the EU must rebrand and appeal to their constituents if they want to stay in power. The new direction of the bossy state is as much about the political elite losing grip of its purpose as the tech companies believing they have the Midas touch and have become invincible.