Expanding on the discussion of globalisation's winners and losers, this article delves further into the causes and history of inequality.

In "Capital in the 21st Century," Thomas Piketty challenges the conventional wisdom held by modern economists that capitalism reduces inequality in the long run.

Modern economists usually rely on the Kuznets curve, which suggests that inequality initially rises when countries industrialise, but eventually falls. That is, capitalism reduces inequality in the long run.

However, Piketty disagrees, arguing that capitalism actually leads to more inequality, and he supports his stance with a decade's worth of additional data.

So what is Piketty's argument on capitalism and inequality?

In short, capitalism thrives on deskilling workers. As technology advances and more machines are introduced into the workforce, workers lose their skills and become easily replaceable.

The result?

You need less labour to produce the same amount of goods, but you need more capital to buy and maintain these machines. Just imagine starting a car company, manufacturing firm or mining company today. You need to be a billionaire just for the capital investment needed.

Karl Marx saw the process of deskilling workers as the downfall of capitalism. As wealth concentrates in the hands of the factory owners, while goods and services start becoming oversupplied, the average worker cannot afford them.

The inequality brought by capitalism would break it down, but even though it looked like this would happen many times (e.g. the 1890s or the 1930s), Capitalism proved to be more resilient than Marx thought.

According to Piketty, Marx's analysis of capitalism had a flaw: it assumed the economy was a non-growing steady-state economy - an assumption very hard to believe today with a constant focus on achieving 2% growth targets.

However, Piketty explains that in the 19th century and before, the economy didn't experience the same growth we see today. He cites novels, like Jane Austen's, where characters could live comfortably on 1000 or 5000 pounds a year, a reality that persisted throughout the century.

This suggests that the idea of a steady-state economy might not be as far-fetched as we initially thought.

As the 20th century began, the UK's national wealth was seven times greater than the nation's economic output. However, over the course of the century, inequality decreased significantly.

According to Thomas Piketty, the prevailing view among mid-20th-century economists that capitalism had undergone a transformation towards greater fairness was flawed.

Piketty suggests that the real reason for the decrease in inequality was the redistribution of wealth caused by the war and decolonization, not due to any inherent changes in the capitalist system.

When war breaks out, investments are bombed, destroyed, and looted, leading to a twisted form of wealth redistribution.

After the Second World War, inequality remained relatively low due to sluggish capital growth and increased taxation on wealth.

According to Piketty, the 1980s marked a turning point for inequality in the Western world, triggered by a snowball effect resulting from policy and economic changes. The neoclassical Chicago School, led by Milton Friedman, had a significant influence on the US political landscape during this period.

Thatcher and Reagan implemented policies favouring privatization and trickle-down economics, contributing to the widening gap between the rich and poor. Inequality began to skyrocket, reaching levels similar to the late 19th century.

Piketty’s central contradiction of capitalism

So we established that the mid-20th-century surge in equity was not a result of capitalism's inherent egalitarian nature, but rather a consequence of two world wars and a depression.

Thomas Piketty’s main contribution is what he calls the central contradiction of capitalism: while the rate of return on capital has remained constant at around 5%, the growth rate of the economy has remained close to 0%, with only the last two centuries seeing it inch closer to the 1-2% range that we observe today.

The problem arises when capital owners accumulate wealth faster than the economy grows, leading to an increasing concentration of wealth and assets for the rich.

He acknowledges that the division of wealth among the poor, middle class, and rich is not inherently problematic, but contends that it becomes an issue when these groups do not experience economic growth at roughly the same pace.

The lesson, then, is that if you allow it, capital will concentrate on fewer and fewer hands.

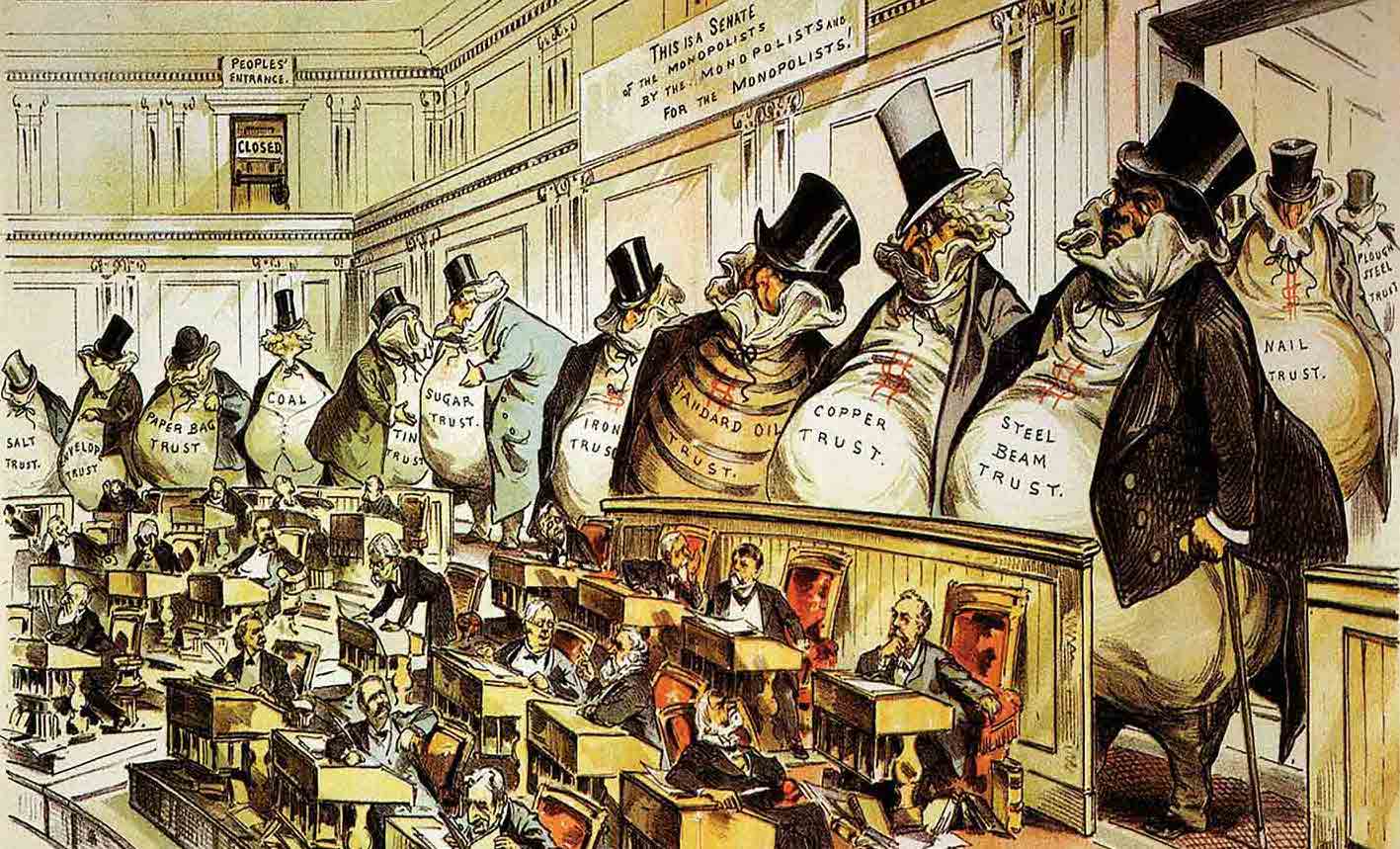

This concentration has significant consequences, as seen in the US, where social mobility has nearly vanished, and the wealthy dominate the political system.

The extreme wealth transfer in the US has contributed to crises in the political system, an unequal education system, an expensive and exclusionary healthcare system, and a lack of social safety nets.

Profound inequality leads to social dysfunction, and this book raises concerns that such inequality could ultimately undermine democracy itself.

To tackle this growing disparity, Piketty proposes a global tax on capital. This solution needs to be international, as we live in a global economy, and we must ensure that capital owners cannot simply shift their assets to avoid taxation.

This measure aims to distribute economic growth more evenly, reducing the concentration of wealth and power in the hands of the few.

As Piketty acknowledges, implementing a global tax on capital is unlikely to happen and appears to be a utopian rather than a pragmatic solution.

In conclusion, Piketty's significant contribution lies in his construction of a more extensive dataset on inequality, giving a numerical narration of the development of inequality. Piketty argues that capitalism seems to reinforce, rather than eliminate inequality, as the rate of return on capital outpaces the growth rate of the economy.

While a new middle class has emerged, society is not more unequal today than it was a hundred years ago. However, the speed at which inequality is rising today is a cause for concern.